200k+ people trust

us

200k+ people trust

us

Annual Compliance of Private Limited (Pvt. Ltd.) Company

Get Annual Compliance Pvt. Ltd. @ Rs.7251 only /- ( Including GST)

Government fees & stamp duties extra. Please fill form to get

detailed quote in seconds.

In 2 Weeks . Transparent Pricing . No Hidden Cost

Get Absolutely Free In Package

Complete Documentation

Tax

Planning

Personal Assistance

Planning and Consultation

Dedicated Support

Get Quote Instantly

Name *

Contact Number *

Email *

City/district *

0 Years

Of Experience

0 +

Cases Solved

0 +

Awards Gained

0 k +

Trusted Clients

0 k+

Queries Solved

Annual Compliance Pvt. Ltd.

Are you a Pvt. Ltd. Company struggling with the complexities of annual compliance? Look no further! Legal251 offers comprehensive services tailored specifically for the Annual Compliance of Private Limited Companies. Our expert team ensures that you meet all legal and regulatory obligations seamlessly, allowing you to focus on growing your business. We handle every aspect of your annual compliance requirements, starting with the Annual General Meeting (AGM). Our professionals will assist in organizing the AGM and guide you through crucial decision-making processes. We will prepare and file all necessary documents with the Registrar of Companies (ROC), including financial statements, annual returns, and any required tax filings. Our expertise extends to compliance with income tax regulations, Goods and Services Tax (GST), and other relevant laws, providing peace of mind. By choosing Legal251, you can avoid penalties, legal complications, and reputational damage that may arise from non-compliance. Our reliable and efficient services ensure that your Pvt. Ltd. Company always remains transparent, accountable, and compliant.

Legal Compliance

Fulfilling annual compliance requirements ensures that your Pvt. Ltd. Company remains compliant with the laws and regulations of India.

Avoid Penalties

Meeting annual compliance obligations helps you avoid penalties and fines that can be imposed for non-compliance.

Smooth Operations

Annual compliance ensures transparency and accountability, leading to smoother operations within the company.

Shareholder Confidence

Conducting Annual General Meetings (AGMs) and filing financial statements instil confidence in shareholders, enhancing their trust in the company.

Good Governance

Annual compliance promotes good governance practices, demonstrating your commitment to ethical business conduct.

Maintaining Reputation

Complying with legal and regulatory obligations safeguards your company's reputation and protects it from negative consequences.

Access to Funding

Many investors and financial institutions require proof of annual compliance before providing funding or investments.

Better Financial Management

The process of annual compliance involves preparing financial statements and analysing the company's financial health, allowing for better financial management and decision-making.

Tax Planning

Compliance with tax regulations enables effective tax planning, maximising savings and minimising tax liabilities.

Stakeholder Communication

The annual compliance process involves communicating with stakeholders, fostering transparency and maintaining strong relationships with suppliers, customers, and partners.

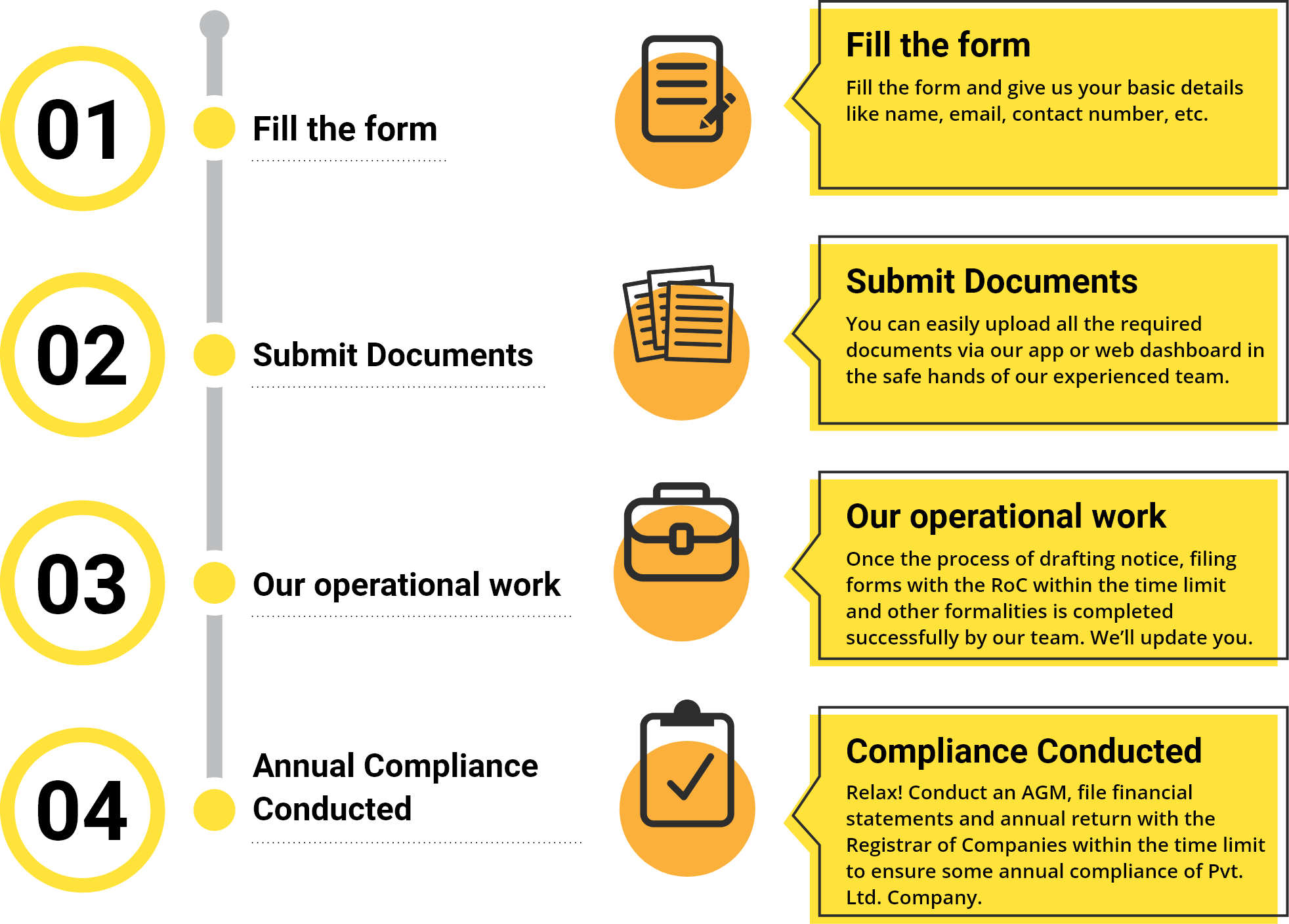

Our team will look into the documents that you have submitted, reviewing any false or mistaken information to keep you comfortable.

Our best GST experts are here to deal with document necessities & to fulfil your registration needs.

Prepare documents, forms, and other necessary documents.

Conduct an Annual General Meeting (AGM) within six months of the fiscal year-end to discuss and approve financial statements, auditors' appointments, and dividends.

Submit annual financial statements and return to the Registrar of Companies, ensuring Pvt. Ltd. Company complies with tax regulations, GST, and relevant laws.

FREQUENTLY ASKED QUESTIONS

Growth & Improvement

We believe in growth and improvement at all costs. For us, growth is the law of life and it shall be fulfilled. We know the importance of business and its growth for you.

Support & Availability

We feel how much pain even a small problem or query can cause, that is the reason we are available to support you and solve any of such problems at every particular instance in time.

Experienced Team

All the members of our team are experienced individuals who believe in professionalism and customer satisfaction above all. Each one of them is passionate in their respective fields.

Focus

Any assigned task is of utmost importance to us, that's why our team members are always focused on taking care of even the smallest of our clients' needs and requirements.

Value for Money

We understand that the money being spent is hard-earned, therefore we utilize every single penny that you pay us in the most effective way possible hence providing the best value for money.

Care & Regards

We believe you to be a part of this family and that all your problems, as well as achievements, are our very own. Your interests are ours and their fulfillment is at the top in our regards.

Hi we are Online!

We are here to help you! Chat with us on WhatsApp for any discount queries or more.